Happy new year to all my beloved (and sorely neglected) subscribers!

After promising and failing to deliver one of these last year, I am nursing a Krug hangover on New Year’s Day and avoiding looking at my own alpha attribution for the year by writing this instead.

Before we continue further, a brief disclaimer: Like all materials produced by strategists everywhere, this is primarily an exercise in wishcasting, creative writing, and quantitative fiction, rather than a serious and sober forecast that should be used to place trades. Especially the more macro-y predictions on markets I seldom to never trade are pure hip-shooting based on vibes and eyeballing charts, which is to say that I have put as much care and thought into these as Goldman does for their annual list of “Top Trades To Stop Out In February On”.

Alright enough of that, let’s get started.

The Outlook:

US Macro

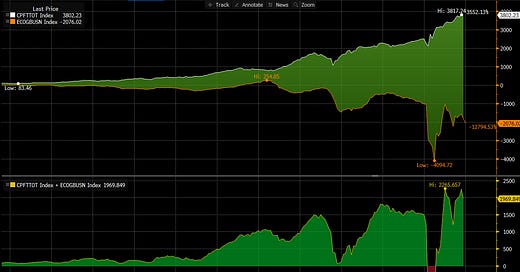

The US economy is very strong right now- unemployment remains low, inflation has returned to target, and interest rates are currently moderate and projected to fall. Corporate profits (about $3.8 trillion annually) are at all time highs in real dollars, nominal dollars, and very close to ATHs as a percentage of corporate gross value added and GNP. However, the US is currently running an extremely large fiscal deficit of about $2 trillion: in other words, over half of US corporate profits are attributable to money flowing into the economy from government deficits right now, rather than investment, which makes predicting its trajectory the primary determinant of economic outcomes for the next few years. As a certified Kalecki-Levy enjoyoooor, the basic point here is a straightforward equation (neglecting dividends and depreciation for simplicity):

Corporate Profits = Investment + Gov’t Deficits + Net Exports - Household Savings

As far as I see it, several factors cut for and against this (+ means good for corporate profits, - means bad. Note I am talking about profits here, not multiples.):

Donald Trump has promised to enact tariffs as one of his highest priority initiatives. This will lower the deficit (-) and increase net exports (+).

Many people assume he will cut taxes in some form or fashion, but I doubt this is as high of a priority (+)

Elon Musk and Vivek Ramaswamy have promised to “pay for” this by radically slashing government spending. Obviously, this is hugely negative for equities, so (-) if it happens, but it is a non-binding advisory position, so it might not happen. In any case, there’s not much room to make huge structural cuts in the government without cutting SS, healthcare, or defense, so I am doubtful that, even if they happen, they will move the needle.

Factors 1 and 2 will be hugely inflationary, if they occur, and the Fed will hike interest rates. This is a big old (+), more money out the door on debt service payments into the hands of debtholders is good for earnings. Factor 3 will be deflationary, but see above.

Consumers will naturally cut spending in an inflationary environment with higher prices for imported goods, which means they will be saving more. This is a giant (-) for corporate profits, since their savings come directly out of the profits of companies that would otherwise be selling things to them.

If I had to pick which ones will happen, I would say a lot of 1, some of 2, very little of 3, a lot of 4, and a moderate amount of 5, unless there’s a recession, in which case there will be a lot of 5. It is a worthwhile exercise- even if you totally disagree with this selection- to actually run the numbers on what you think will happen and what that implies for corporate profits. A lot of very stupid people have assured me that huge government cuts are bullish for stocks because something something Argentina, which is just sloppy analysis.

The natural corollary of the above analysis, which is that corporate profits probably go up further from here, is that there will be a significant surge in inflation. I would not be surprised at all if it got to 5% in the next year on the back of tariffs, which has significant implications for the rates space as well as multiples. Whether or not this puts the US in recession is, I think, an open question shading towards “no”- while I may be a heartless bear, I am not a total doomer, and we have just experienced an episode with an extended surge of inflation, significant fall in stock prices, and no recession under current Fed leadership, so it is possible we will see a repeat of that again. It is also possible that Smoot-Hawley 2.0 will usher in the total collapse of the global financial system and we’ll need to use our Bloomberg terminals to beat each other to death on Fifth Avenue over the last can of tinned soup in Manhattan, but that feels less likely than a redux of 2022.

“Price” Targets

US Real GDP: +1% YoY.

US Nominal GDP: +4% YoY.

CPI: +3.5% YoY, Q4 at 5% annualized.

Corporate Profits After Tax: $4 trillion.

Federal Budget Deficit: $2.5 trillion.

US Equities

Cards on the table here: for the past few years, dramatic reversals have accompanied calendar year changes, and I expect this to be the case in 2025. I expect that equity markets will sell off hard in January, a la 2022, with selling concentrated especially in the big thematic winners of 2024 (AI, crypto, quantum, Telsa, etc.). Given index concentration, the people constantly kvetching about how 10 or 15 or 28.3 stocks make up 40% of the index will have a point, and indexes will fall lower, though they could pick up momentum and rally afterwards. The garbage highly shorted names, however, will not, and there will likely be divergence between the, a la mid to late 2021.

Price Targets

S&P 500: 5,000 by EOY. Touches 4500 intra-year. Extra spicy prediction: Does not break 6,000—Mr. Gorbachev, tear down this call wall!

NASDAQ: 17,000 by EOY. Touches 15,000 intra-year.

Russell 2000: 2,000 by EOY. Closes on the lows.

GS Highly Shorted: 100 by EOY. Closes on the lows.

Foreign Equities

The picture ex-US is much rosier, largely driven by a macro environment that could inflect higher and far more supportive valuations. I expect significant relative outperformance vs. the US in the home currencies, though given likely dollar appreciation (see below), this may not translate to returns for US investors. Japan is my favorite ex-US market, though I actually quite like a lot of Europe as well, especially given the increased likelihood of an end to the conflict in Ukraine and a normalization of energy prices.

Price Targets

Topix: 3,500 by EOY. Closes on the highs.

Eurostoxx: 5,500 by EOY. Touches 6,000 intra-year.

MSCI EAFE: 2,600 by EOY. Closes on the highs.

Shanghai Composite: 4,000 by EOY. Touches 5,000 intra-year.

MSCI Emerging Markets: 1,100 by EOY. Touches 1,200 intra-year.

Rates

I think it is extremely likely- certainly likelier than the market does- that there will be either significant inflation or very aggressive Fed hiking to preemptively control it. The spillover will likely pause or maybe even reverse the global cutting cycle due to currency effects, but I don’t have it in my to produce even a half-assed prediction of UK rates or whatever.

Price Targets

Fed Funds: 5% by EOY. Touches 4% intra-year.

US 10-year nominal: 5.5% by EOY. Closes on the high.

US 10-year TIPS: 2.5%. Closes on the high.

Currencies

When I was young and stupid, I foolishly assumed that currencies traded on economic fundamentals or relative price levels or something. Nope! It’s all short term interest rate differentials and carry trade risk on/off moves, so plug and chug the above predictions to figure this one out.

Price Targets

Euro: 0.95. Pity about those 20% wine tariffs, though.

Yen: 140, Japan hike cycle actually follows through.

Pound: 1.15.

Broad trade-weighted USD: 135. Sucks to be an EM, I guess.

Commodities

I’ve always been a big believer in chart voodoo for commodities, and the charts in this space look pretty bullish to me. If you think that China can dodge a trade war related recession then I don’t see why this can’t rip a lot higher, especially if there’s US inflation.

Price Targets

Gold: 3000 by EOY. Closes on the highs.

Brent: Unch’d on year, volatile intra-year.

BBG Commodity index: 115 by EOY, touches 120 intra-year.

Credit

I don’t actually know anything about credit, but that hasn’t stopped me in the past and it won’t stop me now!

Price Targets

5y NA IG CDS spread: 80 bps by EOY. Closes on the highs.

5y NA HY CDS spread: 500 bps by EOY. Closes on the highs.

Crypto And Other Bullshit

I hate that I have to even pretend to care about this. My boss has successfully convinced me that Bitcoin will probably go up forever, but I find it hard to believe it can dodge a broader risk-off move in the market, though who knows, it might perk up from inflation (is that still a thing people believe? I never bought it in the first place). All the other Fartcoin meme stuff, however, cannot: there’s always someone with even more brain damage who can issue another even stupider one, so the issuance eventually swamps demand and the market collapses (see: BTC up over 100% since Q2 2021 and Bored Apes down 90% over the same period).

Price Targets

Bitcoin: 70k by EOY. Touches 60k intra-year.

The other “good” coins (SOL, ETH, whatever): Down 50-70% by EOY, closes on the lows.

Various dogshit, canine, and scatological coins: Down 80% or more, closes on the lows.

Black Swans (H5N1, Nukes, Taiwan invasion)

There will be none of these, as nothing ever happens.

Price Targets

Happenings: 0 by EOY. Approaches, but does not break, 1 intra-year.

Conclusion

I don’t need to even write any footnotes this post, because all the above predictions are 100% guaranteed to happen without exception. Now get out there and make some money.

Until next time,

Q.

fading on crypto... smh

Thanks Q! Happy new year.