2026 Market Outlook

Or, It's Just Gonna Suck For A While And Then You'll Be Fine

Welcome to my one regularly scheduled Substack post, where I spend the New Year’s holiday in a raclette-induced stupor LARPing as a global macro trader instead of doing my actual job.

If I had to boil down this outlook to a single sentence, it would be this: financial assets are currently extremely overvalued and the outlook for forward returns is dim across the board. A correction in either time or price is required for future outcomes to be in line with historical norms, let alone current expectations. My suspicion is that we will see both, in the form of a slow, multi-year grind lower that might not even be recognized as a bear market until years from now, coupled with persistently negative real interest rates eroding the purchasing power of “safer” investments. To make matters even worse, the rapid repricing of potential safe havens means I don’t even see any potential bright spots of outsized return in other asset classes to make up for weakness in the bulk of the portfolio.1

In an environment like this, capital preservation is the name of the game. Everyone knows the grim logarithmic math of drawdowns: 50% down means you need +100% to break even, -65% requires +200%, -80% means you need fully 400%. Now, to be clear, I’m not saying you should run out and get max short today because everything is going to 0. Indeed, if you aren’t absolutely levered to gills long shitbeta right now, you’ll probably be fine eventually, but why take one on the chin and endure a multi-year bear market when you can cut back your net within 1% of all time highs and dodge the punch entirely?

The Outlook:

US Macro, By Which I Mean AI

Readers of last year’s forecast will note that I did not discuss AI at all, except perhaps as a passing reference to index concentration, preferring instead to discuss more broad-strokes trends in inflation, GDP, corporate profits, etc. If there’s one thing this year makes clear, it’s that lol that nerd shit doesn’t matter, and even if it did I no longer think anyone has the capability to forecast what the administration will do that will affect this, so I certainly won’t try. Instead, I will spend this section discussing the relevant big picture macro factor, which is the AI trade. A lot of discussion in the space consists of bulls and bears talking past each other about how their preferred metrics proves their thesis: Bulls spend their days discussing frontier model capabilities, ambitious capex plans, growth in total token consumption, business use cases, etc.; bears argue over the finer points of depreciation schedules, financing structures and CDS spreads, end user stickiness, or monetization plans.

While it’s fun to yell at people on Twitter- and possibly even more fun to yell at people on Bluesky- the entire exercise is mostly backwards looking narrative fitting to price action. It’s not actually necessary to listen to a Gavin Baker podcast or read a Michael Burry Substack obsessing over the details to understand what’s going on: AI names didn’t trade up because investors were deep in the weeds about tokens per watt, and they won’t trade down because the same people suddenly developed a considered opinion about the useful life of a GPU. In any narrative driven speculation cycle, interest starts (often quite legitimately!) in a core of high-quality companies exposed to the theme, and ripples outwards from there to progressively lower and lower quality names that are pumped higher and faster with the unrealized profits from the last round. In the case of the AI trade, first it was critical to have exposure to semis, then the exposure people wanted was in data center providers and neoclouds, then in data center power and service providers and other supply chain participants, eventually spreading from there to companies with optionality to pivot into AI from existing assets or business lines, and finally culminating in empty shells with no business or assets whatsoever catching huge bids just for saying they had exposure to AI.

The reason this works so well is also the reason it doesn’t: The flywheel spins in both directions. Look at the crypto treasury space midyear as an example of this dynamic: the proliferation of the model from a handful of real (well, real-ish) business to scammers desperate for a quick buck resulted in increasingly large pumps followed by increasingly sharp drawdowns, all on a backdrop of positive news for the actual underlying asset. Then, as soon as there were no more crappy assets to sell (because they were all -80%), the good ones were all that was left to be sold and promptly got cut in half.

Has this unwind process begun in earnest for AI, or are we witnessing a momentary blip before the process resumes? I have a very strong suspicion it is the former rather than the latter. The current environment is a standoff where everybody plans on being the first person out the door when it turns, and the more people rush for the exits, the smaller they invariably turn out to be.

US Equities

The US equity outlook follows straightforwardly from the above. Unlike crypto, which is contained to gamblers almost by definition (nobody buying Cardano or whatever actually thinks they are doing serious capital formation, even David Sacks), AI names make up an extremely material proportion of US market capitalization, and so any unwind would have outsized impact on the headline index. If the peak of speculative excess was in mid-October, as I believe it was, then the progressive unwind will create an equity market that looks a lot like 2000: a sequence of slow but increasingly deep drawdowns punctuated with sharp countertrend rallies that fail to break to new highs before being followed by lower lows.

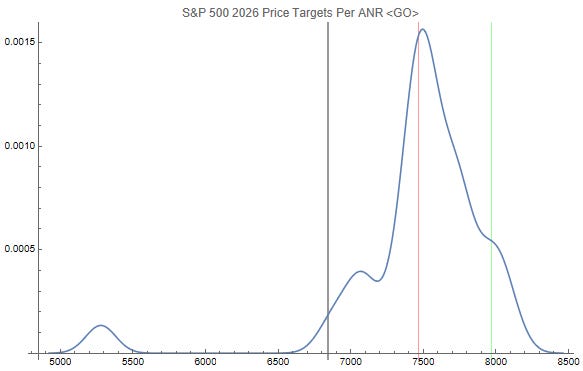

Naturally, none of this has prevented any strategist from producing their SPX targets the old fashioned way: picking their favorite integer multiple of 100 6-12% above the EOY close. I, however, will perform the more sophisticated method of picking the emptiest point in the distribution above in order to maximize the probability of getting to say “I told you so”.

For other indexes, you might think- as someone who is ostensibly paid to pick small caps among other things- that I might like buying small caps here. The answer is no. Of course, think long quality small cap value names will win in the long term, but this is a macro forecast not a single-name newsletter. In practice the Russell (and even the S&P 600 to a lesser extent) sucks as a way to express that view: you’re actually long tons dogshit quantum names and speculative AI plays with more beta to NDX, rather than less.

Price Targets:

S&P 500: 6,000, elevated VIX throughout the year, but no prominent spikes/drawdowns like we saw in 2020 or April 2025

NASDAQ: 18,000

Russell 2000: 2000, it’s right in the name

GS Highly Shorted: 150

Foreign Equities

At the beginning of last year, I was a big fan of long left-behind DM equities, including European and Japanese names most prominently. The market has already come around to that view and repriced them faster than the fundamentals could catch up, making them less attractive on a go-forward basis, especially in Europe. If you were max long, time to trim, if you’re still underweight, there’s still time to buy more. Japan is more attractive on a relative basis. EM names have run a lot on dollar weakness, and I suspect might dip on dollar strength in the first part of the year, but that is also a buyable dip.

Price Targets

TOPIX: 4,200

Eurostoxx: 6,500

MSCI EAFE: 3,500

Shanghai Composite: 5,000

MSCI Emerging Markets: 1,600

Rates

In January last year, I was full of naïve, childlike wonder at the world. I believed in all sorts of fake things: Santa Claus, the Easter Bunny, and Fed independence. No more. Inflation does not matter anymore and when the President picks his favorite Kevin to run the Fed, cuts will resume come hell or high water. If the long end even bothers to panic, it will quickly decide to un-panic after a few trial balloons about Operation Twist 3.1-thinking-high are floated. The only transmission channel for concerns about US government finances that will work as a trade will be the USD and, possibly, TIPS- but as many people learned for the first time during the shutdown, there’s also a mechanism for controlling those if it turns problematic, so as a hedge they are inferior to other alternatives.

Price Targets

Fed Funds: 3%

US 10-year nominal: 3.5%

US 10-year TIPS: 1%

Currencies

Last year, the theme that everyone was worked up about was “debasement”- if the US dollar lost primacy, then where would the money go? For a brief moment, the answer appeared to be the Euro, at least until people realized that the EU’s specialty was folding like a wet paper bag at the slightest American pressure and the rally stalled. With characteristic Japanese efficiency, the yen didn’t even bother with that, ending the year almost perfectly unchanged.

Given the strength of the narrative and size of the moves, it wouldn’t surprise me at all if we had a bit of a dollar rally in the first part of the year, on the order of 5% or so. I expect the resumption of rate cuts in the US will cause this to entirely revert and then continue the depreciation, albeit at a more modest pace.

Price Targets

Euro: 1.25

Yen: 145

Pound: 1.40

Broad trade-weighted dollar: 115

Commodities

The big winner last year wasn’t bonds, TIPS, currencies, Bitcoin, or even stocks- it was good old gold. In an absolutely relentless parabolic advance, it marched higher and higher without bothering to have even a 10% drawdown. Unlike Bitcoin, however, there’s always more gold to be mined; but exactly like Bitcoin, there’s an infinite supply of sketchy Canadian executives promising vast riches to a pool of credulous retail investors if only they could have a few hundred million to get the mine online. New capacity will always chase higher prices. I suspect we take a breather and consolidate for a while, but I don’t see any massive downside in the near-term.

On the more economically relevant commodities, I expect a modest pullback followed by a bounce afterwards. Crude, however, is already quite cheap, and I don’t see tremendous extra downside here.

Price Targets

Gold: 4,000

Brent: 70

BBG Commodity Index: 110

Credit

Here’s a spicy meatball for you: I actually quite like the idea of public market HY credit (and in a similar vein, EM sovereign credit) here, even if the spreads aren’t particularly juicy. I suspect that a lot of the real stinkers that would normally blow up the index have been adversely selected into the private credit market, so while that’s bad news for Midwestern dentists and Canadian pension funds, there’s probably value to be had buying any dip in the public credits here. IG, on the other hand, is extremely tight with minimal potential for narrowing further, with significant risk it could be caught offsides in a broader selloff of megacap names given increasing exposure to the theme via new issuance.

Price Targets

5y NA IG CDS Spread: 100 bps

5y NA HY CDS Spread: 400 bps

Crypto

In a quiet year of professional trading, Bitcoin closed down about 10%, and nothing particularly remarkable happened along the way. Hahaha, I crack myself up sometimes. The death of the public treasury company model- among the dumbest and certainly the most annoying financial “innovation” ever developed to separate retail investors from their money- is a wet blanket over the space. At an aggregate 10-15% discount, everyone can hold their breath and pretend they’ll be back to their high water mark shortly, but if things widen into the 30’s activists will start showing up at the doors demanding crypto sales and stock buybacks. Bitcoin itself has resilient demand via ETFs, so I doubt it can fall tremendously far, but everything else does not, and the most mercenary opportunists in the space have already left it for dead and pivoted to AI to make a quick buck instead (perhaps that is long-term bullish, but it’s certainly bearish in the short term as capital flows are redirected elsewhere).

Altcoins (do people even still call them that or have I identified myself as a cheugy millennial?) have gotten destroyed already in the past year. Still, you can always go down another 100%, so why not, another 50% downside.

Price Targets

Bitcoin: 75,000

Major coins: Down 30-50%

Everything else: Down over 50%

Black Swans

Here is where another, lesser strategist would put the generic cop-out of “oh geopolitical volatility is high” to cover your ludicrously high price targets in the event of a selloff. However, ever the contrarian, I would argue that geopolitical risk is not actually a particularly relevant catalyst for markets here, especially when compared to valuation. Selloffs are more likely to be sparked by idiosyncratic factors, more sellers than buyers, or just poor economic news. The Fed replacement and US midterm elections loom much larger in my mind as potential downside catalysts than broader geopolitical risks.

Price Targets

Happenings: 0. Yes, even Venezuela doesn’t count, sorry.

Conclusion

If you’ll permit me, I’d like to defend the idea of being a vocal bear in this day and age. A frequent critique levelled at contrarians (and make no mistake, in a world that is roughly 102% long and 2% short, being bearish IS the contrarian opinion) is of the form: why even bother? The historical track record of equities is so overwhelmingly positive, compounding such a powerful force over the long term, that by entertaining even the shadow of a doubt about how bright the future is, you’re only kneecapping your own investment returns. Shut up and hit the buy button, and don’t look at your account lest you be tempted to sell (or, even better, allocate to privates so you can’t sell, taking the decision entirely out of your hands for a mere 2 and 20 to Blackstone). It’s easy to find charts showing the market’s relentless march higher annotated with dire headlines predicting doom; or a nice histogram demonstrating that while yes, 1 year returns might be volatile, if you stick it out for 10 or 20 years you’re guaranteed a positive real return; or any number of quotes from bygone pessimists about how cars or air travel or computers or the Internet were just passing fads.

To that, my rebuttal would be: you need to be for fucking real. Blithely extrapolating a trend line indefinitely on a log scale is not a substitute for analysis, even if it passes for such in Silicon Valley. Valuation, market dynamics, investor positioning, mean reversion; these are all things that matter, and they tend to matter in inverse proportion to much you hear people talk about them. A contrarian, and especially a public contrarian, is most valuable at the precise moment their input is most unwanted; in a certain sense the best valuation metric of all isn’t given by a chart of the Shiller CAPE, but the number of charts of the Shiller CAPE one encounters. Perhaps it’s futile to be the one who posts them, and such mementos mori aren’t actually necessary, given that some variant of “Past performance is no guarantee of future return” is printed on every financial document in existence. Still, bull markets select for farsightedness, and this one has richly rewarded people for it for so long that quite a few have lost their ability to read fine print entirely.

Take care you aren’t among them,

Q.

The only exception is high-quality timberland. Just kidding, private assets are arguably the most grotesquely overvalued of all, but I’m not really focusing on those in this note since they aren’t tradeable and there’s very little good data available.

Well-written, thank you.

Your witty, tongue-in-cheek tone, mocking the excesses of a frothy bull market, yet unafraid to be self-deprecating where appropriate, is much appreciated.

With these kinds of outlooks the story and narrative are far more useful than specific predictions or targets.

May we contrarians survive 2026 better than most.

Guess this going to turn out as well as your 2025 memo ( SPY to 5000 EOY LOL)