Market Prices Are Not Probabilities

And no, they aren't valuations either

Welcome back to my once-annual longform Substack post. Today, I want to use this platform to litigate a topic which has been annoying me repeatedly on online and has now started to escape containment into real life, which is of course the highest and best use of this platform.

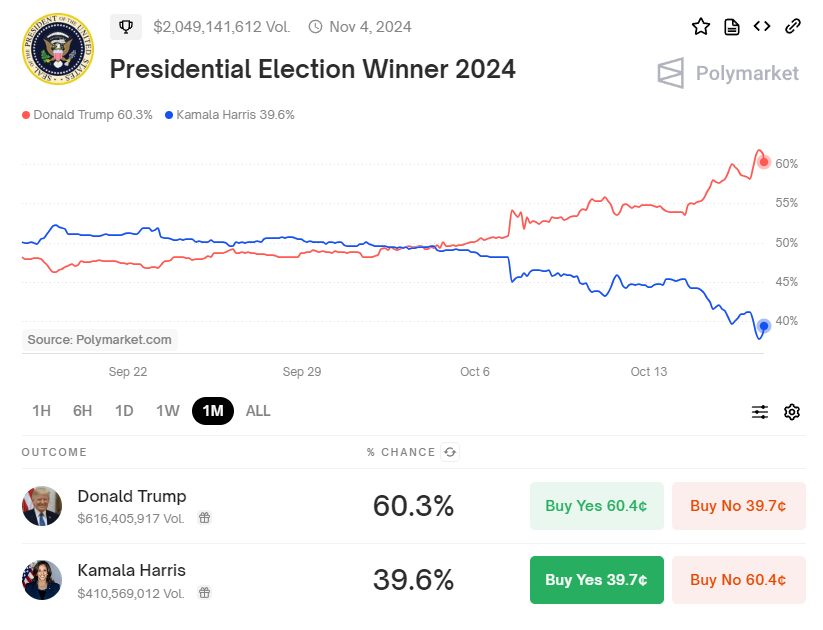

As some of you may be aware, there is a US election happening in three weeks, a topic which has attracted a modest level of attention on X Dot Com, The Everything App. While these happen regularly, this one is of special interest to a narrow slice of highly engaged voters/degenerate gamblers, as this will be the first Presidential election to have what could be reasonably considered to be deep and liquid betting markets (PredictIt, with its $850 limit, does not count). In recent weeks, these markets have begun to get a great deal of mainstream coverage: While high-quality polling tends to show a fairly consistent and stable lead of 2-3% for Kamala Harris, prediction markets (most notably the popular cryptocurrency site Polymarket) have swung significantly in favor of Donald Trump over the past month. Harris Yes contract prices have fallen 15 points from about 53 to about 38, despite no major news flow or material polling shifts:

This movement has occurred on real volume (nearly $2 billion of shares have traded hands on the market since inception) and many prognosticators have interpreted this as drop in Harris’ odds of winning the presidential election. This is false, and also very stupid, and while I enjoy telling people online they are wrong, I grow annoyed at the fact that I need to point this out multiple times per week and every time I do fifty people jump in with the asinine retort “well if you think the prices are so wrong, just bet on Kamala and make a ton of money”1.

If this blog can be said to have a theme, it is that market microstructure and trading impact matter much more than low-frequency participants might think. Contra Ben Graham, in the short term the market is a voting machine, and in the long term is it still a voting machine. One of my favorite finance papers of all time lays out the result that, under reasonable models of trading activity, price impact, and portfolio size, large price movements in equities are primarily driven not by rational adjustments to meaningful price signals, but the trade impacts of massive institutions trading erroneous signals they believe to be meaningful2. Limits to arbitrage are real and produce persistent mispricings which may grow rather than shrink over time, and this is all happening is in an extremely sophisticated setting where hundreds of billions of dollars and some of the smartest people and most sophisticated technology in the world is being deployed. If limitations persist even at that scale, then an offshore cryptocurrency-based gambling website certainly has… issues… as well.

The core problem with prediction market sites is inherent to their specific market structure: the central limit order book.3 While an enormous amount of ink and several Nobel prizes have been awarded based on the presumption that, if only sufficient liquidity and sufficiently informed traders are present, markets will eventually arrive at the “right” price (usually defined as the aesthetic preferences of the writer), this is, as a matter of objective fact

ONE HUNDRED PERCENT INCORRECT

(read that in the Bene Gesserit voice for maximum effect). The purpose of the CLOB structure is NOT to produce a price which is correct when measured against some objective external benchmark, but rather to produce a price which is internally consistent by balancing buying and selling flow in the order book. The only way to know if your price is right is if, upon quoting a market around that price, interacting with incoming orders produces a net profit and zero average position over time. If YHWH Himself hands you the True Fair Value down from Mt. Sinai etched onto stone Excel workbooks, and quoting that price causes people to persistently buy it from you, then YHWH’s price is F***ING WRONG.

The widespread, incorrect interpretation of prediction markets as probabilities is honestly not too surprising, given that Polymarket’s own website explicitly tells people that it is the case and every news article ever written by journalists about Polymarket also endorses the price = probability theory of prediction market CLOBs. To demonstrate in exhaustive detail why this is not the case, let’s walk through a toy prediction market, which for legal reasons we will call Monomarket, as it offers contracts on a single event: the 2024 US Presidential Election. Monomarket works as follows: contracts trade for a price between $0 and $100, and there are two pairs of contracts, Yes and No, whose price sums to $100. There are no commissions, fees, or spreads; interest rates are 0%; and no taxes paid on winnings. Shares of the winning candidate receive a $100 payout, and the losing candidate’s shares are cancelled and become worthless. Shares of both contracts can be bought or sold, but cannot be borrowed, optioned, or sold short. For ease and convince of visualization, I will pretend there’s a single contract on Monomarket—Trump Yes—but keep in mind that you cannot have a negative position in a contract: if you think Trump Yes is overpriced and you do not already have a long position you can close out, you need to buy Harris Yes to express that bet.

Initially, Monomarket is exclusively dominated by woke liberals. There are 10 of them (pictured above), and each have independently come to the conclusion that their subjective probability of Trump winning is 25%. Each has $10,000 to bet on this outcome, and they are all completely rational and unencumbered by political prior save those used in forming their initial opinion: all would happily bet on a Trump win at a price below 24, and a Harris win at a price above 26. Unfortunately for them, Monomarket is 24 bid and 26 offered, so no trading is happening and everyone is flat shares and 100% cash. However, our woke libs are obliging enough to leave resting orders in the book spread evenly across all the prices, such that they each would only hit their max risk limits if the price went to $0 or $100, respectively.

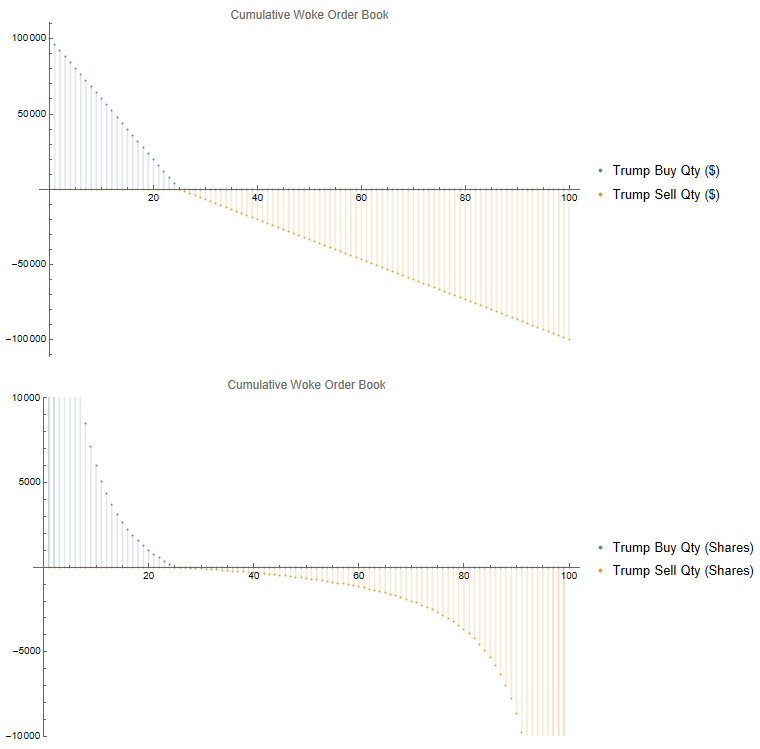

While this produces a demand which is linear in dollars, when translated into share terms demand becomes very nonlinear. Buying $20,000 worth of shares at a price of $20 is only 1,000 shares, while buying $100,000 worth of shares at a price of $1 is 100,000 shares. The cumulative4 order books end up looking something like the below (I’ve chopped off the tails for visualization purposes):

At this stage, because all participants are identical, the market price of $25 actually represents the average probability all 10 traders would assign to the outcome, so it appears as if our prediction market is “working” the way people think. However, it won’t function for long, because a new participant just arrived at Monomarket: a based conservative. He has exactly has the same trading decision rules as the liberals, the same utility function, and the same initial bankroll ($10,000). However, his subjective assessment of the win probabilities are flipped: he thinks Trump has a 75% chance of winning and bets accordingly (note the y-axis shift, since he’s 1/10th their size):

This 11 person population now has both a person- and money-weighted expectation of a (10*25% + 1*75%)/11 = 29.5% probability of Trump winning, so if political betting markets do truly reflect the average probability assessment of participants, Monomarket should trade at 29 bid 30 offered.

Here’s the $2 billion question, though: Given the above belief distribution, what price does this market actually trade at? Feel free to pause her and noodle it out—it shouldn’t be that hard to eyeball things or use trader’s intuition. The answer is below this picture of a horse race, specifically Rich Strike’s 2022 Kentucky Derby win (a little hint for the real degenerates)

If you net the quantities of all trades against each other, the market clears at a price of 33.33 or 33 bid/34 offered, fully 13% higher than the participant’s actual averaged beliefs:

This is because of the fact that a longshot bet is significantly more convex than its converse : if something should trade for 75 you get a 2.5 or 3 to one payout buying the Yes contract in size at 20, 25, 30, 35, 40, etc., whereas someone who thinks the No contract is fairly priced at 75 and not worth trading isn’t going to be incredibly interested in being massively long it at 70. As a result, the price can get chased way up the book until the requisite sell quantities appear to meet demand. Even a small participant would rationally bet a lot higher fraction of their capital for that kind of upside, and a collectively much richer or more sophisticated group wouldn’t be in a hurry to stake out more than a tiny fraction of their collective bankroll to correct the pricing. In horse racing terms, betting markets exhibit persistent favorite-longshot behavior (I’m not calling it “bias” because there’s no irrationality here- everybody in this model is betting precisely their optimal Kelly fraction, given their own subjective probability assessments and the market prices). This is why, as another prominent example, RFK Jr. prices were always significantly higher than his actual probability of winning the election (zero point zero zero percent, rounding up): it only takes a tiny number of true believers to push longshot prices way above their fair value, and people are not going to take sub-tbill returns to buy a 98% “no” contract expiring in 6 months.

Does this mean all is lost, and prediction markets should be discarded in their entirety? Not quite. A very good paper by pointed out to me on Twitter by the inimitable Dan Davies demonstrates that despite this difficulty, it’s still possible to extract bounds on prediction market prices from average beliefs and vice versa. While variance in opinions produces variance between the market price and average belief, the fact that prices are restricted to (0,1) means that the variance is bounded from above, and thus the mispricing is bounded too. Several of the models have more complicated expressions based on more complex assumptions about investor risk aversion and trading strategy, but the most relevant case to highly polarized, partisan markets like political betting is extremely simple. If participants have a fixed dollar risk limit (“fun” money to gamble with) and market buy their preferred side in a single transaction irrespective of the current price, then the most we can say about a market price of 0<x<1 is that the true average probability p satisfies x² < p < 2x-x². As you can see below, this is a very loose bound indeed!

The conclusion of the above argument and papers is of course purely theoretical. After all, in order for it to be relevant in practice, you’d need more than just a thought experiment about a large, politically motivated trader placing significant bets. You’d need to find actual evidence someone was placing tens of millions worth of bets on just one side, who would be one of the largest traders on the site, systematically purchasing every correlated contract they could, and market makers withdrawing liquidity from the book to avoid getting run over, resulting in significantly more volatile moves and larger price impact than would be expected from trading volume alone.

But that’s just crazy talk.

Until next time,

Q.

At the risk of alpha leakage here, the answer to this retort is “No shit, I already am”, since in fact there is a very liquid optionable US midcap which enables people to express the exact same view as a Kamala Yes contract with significantly superior payoff structures and tax consequences.

In fact, it may actually be even more rarified than this- in HFT dominated markets like S&P futures, price discovery might not even happen through trades at all, but simply by the submission and cancellation of limit orders, as quoting volume is orders of magnitude higher than trading volume.

There are many different ways to gamble- one that may be familiar to those who play the ponies is the pari-mutuel method, where investors commit money to a pot without necessarily knowing their own entry price or fixed payoff, as the total pot less fees is distributed pro rata to those who bet on the winner, and thus your effective odds can change as further bets are placed once yours is in. From a strict market efficiency perspective this is probably a superior system for betting on binary events, but it suffers from a Mexican standoff problem where everyone is incentivized to place their bets at the last possible second to avoid tipping their hand to private information. As a result, prices are very uninformative prior to books closing and you can’t do, well, horse-race style coverage of the current market the way you can with a CLOB.

Often order books are represented as qty @ px, but my graphs all depict qty @ px or better so I could just sum the two books together instead of needing to implement a matching engine in Mathematica. If you are familiar with Bloomberg’s MDM function, I am showing the “Total” column rather than the “Size” column.

You assume limit orders are linear in dollars instead of shares. With CARA/normal and common volatility, limit orders are linear in shares and prices are beliefs weighted by reciprocal risk-aversion.

If this is all true then why do we see a good "track record" of these markets?

> https://electionbettingodds.com/TrackRecord.html

> There is also a decent correlation with other models (ie Nate Silver). and polls

Based on this doesn't it seem like by the time the election comes market prices are probabilities?